The Ultimate Guide to Debt Management: Tips and Strategies

As an Amazon Associate, I earn from qualifying purchases.

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. You can read our affiliate disclosure in our privacy policy.

The Ultimate Guide to Debt Management: Tips and Strategies

Let’s face it, debt can cause a lot of anxiety and worry, and dealing with it in a responsible and strategic way is crucial to avoid falling into financial trouble. Luckily, we’ve got you covered with everything you need to know about debt management in this guide. Get ready to discover the ins and outs of managing your debt, from understanding what it is and how to do it, to comparing it to other options like debt consolidation or bankruptcy. We’ll even give you some insider tips on finding the best debt management companies, enrolling in a plan, and avoiding future debt. So, say goodbye to sleepless nights and hello to financial freedom – this guide is your first step.

Understanding Debt Management

Debt management involves creating a customized plan to pay off your debt and manage your finances like a pro. From budgeting to negotiating with creditors to consolidating debt – there are many strategies to help you reach financial freedom. Smart tip: prioritize high-interest debts to save big bucks on interest payments. Feeling overwhelmed? A financial advisor or credit counselor can provide expert guidance and help you develop a successful debt management plan. With the right approach, you can pay off your debts in an organized way and enjoy financial stability.

What is Debt Management?

Looking to kiss your debt goodbye? Debt management is the name of the game. It’s all about taking control of your finances and creating a plan that works for you. Think of it like a recipe with several key ingredients: budgeting, negotiation, and consolidation. But how do you make sure you’re doing it right? Prioritization is key – focus on paying off high-interest debts first to save money in the long run. And don’t forget to craft a realistic plan that fits your unique situation. Feeling overwhelmed? It’s time to bring in the experts. A financial advisor or credit counselor can give you the guidance you need to manage your debt successfully. With the right tools and mindset, you can become the master of your money and say goodbye to debt for good.

How Debt Management Works

Debt management is the name of the game. It’s all about taking control of your finances and creating a plan that works for you. Think of it like a recipe with several key ingredients: budgeting, negotiation, and consolidation. But how do you make sure you’re doing it right? Prioritization is key – focus on paying off high-interest debts first to save money in the long run. And don’t forget to craft a realistic plan that fits your unique situation. Feeling overwhelmed? It’s time to bring in the experts. A financial advisor or credit counselor can give you the guidance you need to manage your debt successfully. With the right tools and mindset, you can become the master of your money and say goodbye to debt for good.

Benefits and Drawbacks of Debt Management

Debt management might be just the solution you need. This process involves creating a personalized plan to pay off your debts in a systematic and effective way. With the help of a reputable credit counseling agency, you can negotiate with your creditors to reduce interest rates or monthly payments so that debt repayment becomes more manageable. These agencies often require a single monthly payment that they distribute to your creditors for you. Not only will this help you tackle your debts, but it can also improve your credit score and overall financial stability. Keep in mind, though, that it’s important to understand the fees associated with credit counseling and the potential impact on your credit score before diving in. But with a solid plan in place, you can say goodbye to pesky debts and hello to a brighter financial future.

Pros of Debt Management

Become the boss of your finances with debt management! You could benefit from lower rates, simplified payments, and an improved credit score. Of course, sticking to a repayment plan takes discipline and commitment, and not every program is right for everyone. Don’t let fees and longer repayment terms overwhelm you, because the upsides can truly make a difference. Do your research and compare options to find the debt management program that helps you the most. When it comes to managing debt, you’ve got this!

Cons of Debt Management

Become the boss of your finances with debt management! You could benefit from lower rates, simplified payments, and an improved credit score. Of course, sticking to a repayment plan takes discipline and commitment, and not every program is right for everyone. Don’t let fees and longer repayment terms overwhelm you, because the upsides can truly make a difference. Do your research and compare options to find the debt management program that helps you the most.

Debt Management vs. Other Debt Solutions

It can definitely be a good option, but let’s talk about some things to keep in mind. One thing to be aware of is that it might temporarily lower your credit score. And, there may be some fees involved with the program. That being said, it’s crucial to take the time to carefully research reputable companies that fit your specific situation. With the right plan, you can absolutely start improving your financial stability.

Debt Management vs. Debt Consolidation

Looking for ways to manage your debt can be overwhelming, but don’t worry, there are options available. Two popular ones are debt management and debt consolidation. Even though they both work towards lowering your payments and simplifying your life, they have different approaches. Debt consolidation will help you merge all your debts into one with a lower interest rate. Meanwhile, debt management requires you to work closely with a credit counselor who will create a plan. This option is better suited for people who don’t want another loan or have multiple creditors. Nevertheless, you should keep in mind both pros and cons when deciding. Even though debt consolidation may seem attractive with its lower rates, it could lead to more debt.

Debt Management vs. Bankruptcy

If you’re feeling weighed down by debt, not all hope is lost. There are a few routes you can take to get back on track. One option is Debt Management, which involves partnering with a credit counseling agency to devise a plan that fits your financial situation. On the opposite end of the spectrum, there’s bankruptcy – a legal process that can wipe away some, or all, of your debts. However, keep in mind that the impact it has on your credit long-term may not be worth it. If you’re making enough money to gradually chip away at what you owe and want to avoid having a blemished credit score, then Debt Management might be the ideal choice. But, if you’re dealing with significant debt and need a fresh start, bankruptcy could be just what you need.

Debt Management vs. Debt Settlement

There are a few ways to tackle debt and get your finances back on track. Two popular options are debt management and debt settlement. With debt management, you’ll work with a pro to create a budget and payment plan to pay off your debts over time. It might take a while, but it can help improve your credit score in the long run by showing consistent payments and reducing your overall debt-to-income ratio. On the other hand, debt settlement means negotiating with creditors to settle your debt for less than what you owe. It can be a quicker fix, but it may come at the cost of a hit to your credit score. It’s important to weigh the pros and cons of each option and choose what’s best for your situation.

Finding the Best Debt Management Companies

Are you seeking a debt management company? It’s important to choose wisely! Look for a company with a reputation for success and check reviews or ask for referrals. Be sure to compare fees and find a reasonably priced option that offers quality services. Verify the company’s licensing and accreditation. And don’t forget to consider how well they can create a personalized solution to fit your unique needs. With the right choice, you can take control of your financial future!

Factors to Consider When Choosing a Debt Management Company

Are you struggling with debt and need help managing it? Finding the right debt management company can be a game-changer, but it’s important to know what to look for. Don’t just jump in blindly! Take into consideration factors like the company’s reputation, customer service, and fees. You deserve a personalized solution that suits your specific financial situation. To ensure you get the best service possible, make sure the company is licensed and accredited by reliable organizations. Go the extra mile and read up on reviews and ratings. Most importantly, choose a company that will communicate with you openly and provide the support you need to succeed. You got this!

Ways to Avoid Debt in the Future

Nobody likes feeling burdened by debt, and it can wreak havoc on your financial wellbeing and peace of mind. Luckily, you can prevent future financial struggles by taking a few simple steps. Start by crafting a budget that covers all of your expenses and income – this can help you avoid overspending or impulsive purchases that can quickly add up. Another smart move is to build an emergency fund to cover any unexpected expenses that may come your way, such as medical bills or car repairs. Finally, make sure you avoid unnecessary debts like high-interest credit cards or loans, and don’t hesitate to seek professional help if you’re struggling to manage your finances. By following these tips, you’ll be well on your way to avoiding debt in the future and getting rid of any existing debts you may have.

How to Build a Budget and Stick to It

Here’s a secret: building a budget can make a world of difference. It may sound like a drag, but it’s actually pretty empowering! Start by taking a deep dive into your spending habits and identifying areas where you can cut back. Once you’ve got that down, set some goals that are realistic (and awesome!), and let those guide your spending decisions. Don’t worry, you don’t have to do it all alone – there are tons of apps and tools out there to help keep you on track. And don’t forget to regularly check in and adjust your budget as your income and expenses change. With a little bit of discipline and the right strategy, you’ll be well on your way to keeping debt at bay.

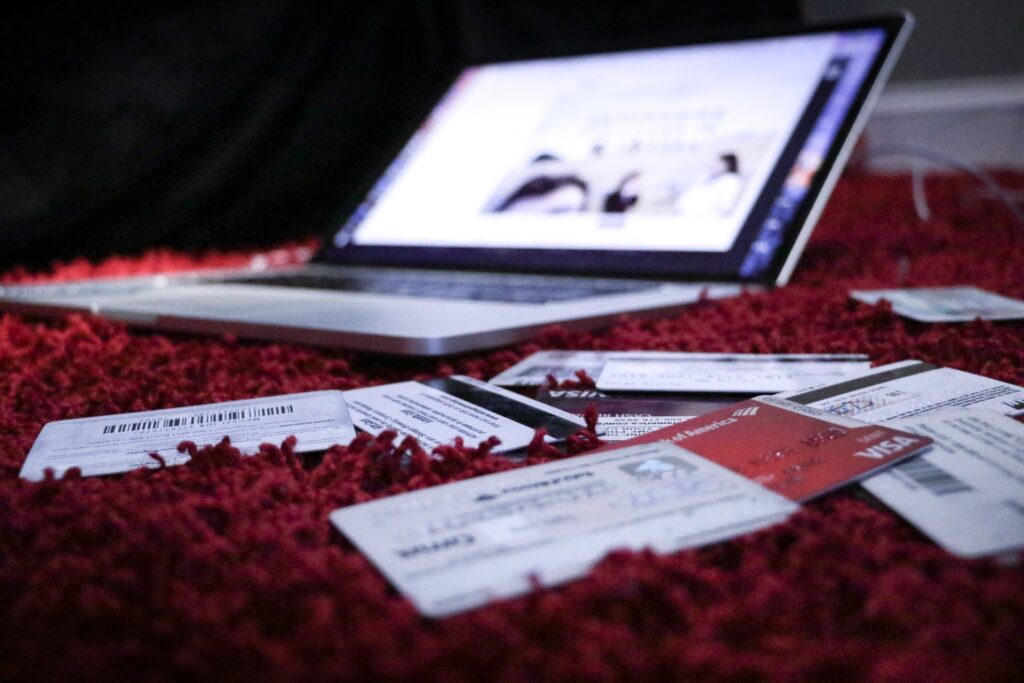

Tips for Managing Credit Card Debt

Managing credit card debt doesn’t have to be a daunting task – there are simple and effective strategies to help you stay on top of your finances. Budgeting and keeping track of your expenses is essential, while paying more than the minimum payment can save you money in the long run. Consolidating your debt with a lower interest loan can also be a useful tool. Finally, remember to avoid taking on new debt until you’ve paid off what you already owe. With these tips in mind, you can take charge of your finances and keep credit card debt under control.

Avoiding High-Interest Loans and Credit Cards

Worrying about debt can be a huge source of stress, but there are things you can do to avoid falling into it in the first place. Watch out for those high-interest loans and credit cards – they can quickly add up and leave you with a mountain of debt that’s hard to climb. Instead, try looking into personal loans with better rates or credit cards that offer rewards to help you save money. Planning a budget and sticking to it can also help you make sure you’re not spending more than you need to. If you do find yourself with some debt, focus on paying off the loans with the highest interest first – it’ll save you money in the long run. With these tips, you can take charge of your finances and avoid any unnecessary stress.

Frequently Asked Questions on Debt Management

Debt management is a process that involves creating a plan to pay off debts while also preventing new ones from accruing. This can be achieved through budgeting, debt consolidation, and negotiating with creditors to lower interest rates or payments. To manage debt effectively, it is important to create a budget and repayment plan that takes into account your income, expenses, and debt obligations. Sticking to this plan can be challenging, but there are tips and strategies for staying motivated and on track, such as setting realistic goals and celebrating small victories. It’s important to remember that managing debt takes time and effort, but it is possible to achieve financial freedom with the right tools and mindset.

Can I Use My Credit Cards While on a Debt Management Plan?

One common question about debt management is whether it is okay to use credit cards while on a debt management plan. While it is generally discouraged, some creditors may allow you to keep one or two credit cards with low balances. However, using credit cards can undermine your progress in paying off debt and may result in additional fees and interest charges.

It’s important to discuss any potential use of credit cards with your debt management counselor before making a decision. It’s also crucial to stick to a budget and avoid accumulating more debt. Ultimately, the goal of a debt management plan is to pay off existing debt, so it’s important to prioritize that goal over any immediate desires for credit card purchases.

How Long Does a Debt Management Plan Last?

When it comes to debt management plans, the length of time they last will depend on the individual’s circumstances and the amount of debt being managed. Typically, a debt management plan lasts between three to five years. The aim of this plan is to pay off all debts in full while making affordable monthly payments.

Creditors may be willing to negotiate lower interest rates, which can help shorten the length of the plan. However, it’s important to stick to the payment schedule outlined in the plan and make timely payments to successfully manage your debt. With discipline and commitment, a debt management plan can be an effective tool in achieving financial stability and becoming debt-free.

Does Debt Management Affect My Credit Score?

One of the most common questions people have about debt management is whether it will affect their credit score. The answer is that debt management can have both positive and negative effects on your credit score.

On the one hand, enrolling in a debt management plan can help you make timely payments and reduce your overall debt. By doing so, you may be able to improve your credit score over time. However, some creditors may report that you are in a debt management plan, which could negatively impact your credit score.

It’s important to carefully consider the potential impact on your credit score before enrolling in a debt management plan. Working with a reputable credit counseling agency can also help you navigate any potential impacts on your credit score and ensure that you are making informed decisions about managing your debts effectively.

Can I Enroll in a Debt Management Plan with Bad Credit?

If you have bad credit, you may be wondering if it’s still possible to enroll in a debt management plan (DMP). The answer is yes, it is still possible to enroll in a DMP even if your credit score isn’t perfect. A DMP is a type of repayment plan that helps you consolidate your debts into one manageable monthly payment.

While your credit score may affect the interest rates and fees associated with your DMP, it does not necessarily disqualify you from enrolling. To ensure that you get the best possible outcome, it’s important to work with a reputable credit counseling agency that can help assess your financial situation and provide guidance on the best course of action.

Enrolling in a DMP can be an effective way to get on top of your debt and improve your overall financial health. By consolidating your debts into one manageable payment, you’ll have an easier time keeping up with payments and paying off what you owe.

How Much Does Debt Management Cost?

For those considering debt management services, one of the most common questions is how much it will cost. The answer varies depending on several factors, such as the provider and the specific services offered. Some providers may charge a flat fee for their services, while others may charge a percentage of the total debt being managed.

It’s important to carefully compare fees and services from different providers before making a decision. Additionally, it’s worth noting that some nonprofit organizations offer free debt management services. While there may be upfront costs associated with debt management, it can ultimately save you money in the long run by reducing interest rates and fees. So, it’s wise to consider all options available before choosing any particular service provider.

Conclusion

Are you struggling with student loan debt, unsecured debt, or credit card balances that seem to be piling up? If so, you’re not alone. Many people find themselves in a tough financial spot at some point in their lives, and it can be hard to figure out what to do next.

One option to consider is debt consolidation. This involves taking out a new loan to pay off all your existing debts, which can make it easier to manage your monthly payments and lower your interest rates. It’s important to find a reputable lender or nonprofit credit counseling agency, such as the National Foundation for Credit Counseling (NFCC), to help you navigate the process and avoid scams.

Another key factor to keep in mind is your credit report and credit history. Late payments, high credit utilization ratios, and collection agency actions can all negatively impact your score, making it harder to get approved for loans and credit in the future. That’s why it’s important to make on-time payments, work with reputable credit repair services if needed, and monitor your credit report regularly.

Ultimately, the best solution for your debt will depend on factors such as the type and amount of debt you have, your repayment period, and how much money you can afford to put towards paying it off each month. But with the right help and resources, it is possible to lower your monthly fees, lower your interest rates, and find a path towards debt relief.

If you’re ready to take control of your finances and find a way to manage your debt, start by researching your options online. Look for trustworthy resources such as the NFCC or Better Business Bureau to guide you towards reputable lenders and credit counseling agencies. And remember, taking small steps towards debt relief can add up to big progress over time.